In today’s dynamic housing market, especially in areas like Ann Arbor, MI, securing a favorable rate on an FHA loan is crucial for aspiring homeowners. Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, understanding how to navigate the landscape of FHA loans can save you thousands over the life of your loan. In this article, we'll explore essential tips and strategies for finding the best rates on FHA loans specifically tailored for Ann Arbor residents.

Understanding FHA Loans

What is an FHA Loan?

An FHA loan is a type of mortgage that's insured by the Federal Housing Administration (FHA). This government-backed insurance allows lenders to offer loans with more flexible credit requirements and lower down payments compared to conventional mortgages. For many buyers in Ann Arbor and surrounding areas like Plymouth and Northville, an FHA mortgage loan can be a practical choice.

Benefits of FHA Loans

Lower Down Payment Requirements: Typically, you can secure an FHA loan with as little as 3.5% down if your credit score is above 580. Flexible Credit Score Requirements: Unlike conventional loans that often require higher scores, FHA loans are more forgiving for applicants with less-than-perfect credit. Assumable Mortgages: If you decide to sell your home, buyers may take over your FHA loan at its current rate, making your property more appealing. Higher Loan Limits: In regions like Michigan, particularly in urban centers such as Ann Arbor, the limits set by HUD can provide sufficient funds for purchasing homes.Tips for Finding the Best Rates on FHA Loans in Ann Arbor, MI

Finding competitive rates can feel overwhelming. However, applying these strategies will enhance your chances of landing a great deal.

Shop Around for Lenders

Just like any major purchase, it pays to shop around when looking for lenders offering FHA loans. Different lenders may have varying rates and fees associated with their mortgage products.

Key Factors to Consider When Comparing Lenders:

- Interest Rates Fees (origination fees, closing costs) Customer Service Reviews Turnaround Time for Approval

Check Your Credit Score

Before applying for any mortgage—especially an FHA loan—check your credit score. A higher credit score typically results in lower interest rates.

Improving Your Credit Score:

- Pay off outstanding debts. Ensure all bills are paid on time. Avoid taking on new debt leading up to your application.

Consider Preapproval

Getting preapproved can give you a better sense of what lenders are willing to offer you and at what interest rates.

Benefits of Mortgage Preapproval:

- Strengthens your position when making an offer on a home Provides a clear budget for house hunting Helps identify potential issues before they arise

Understand Current Market Trends

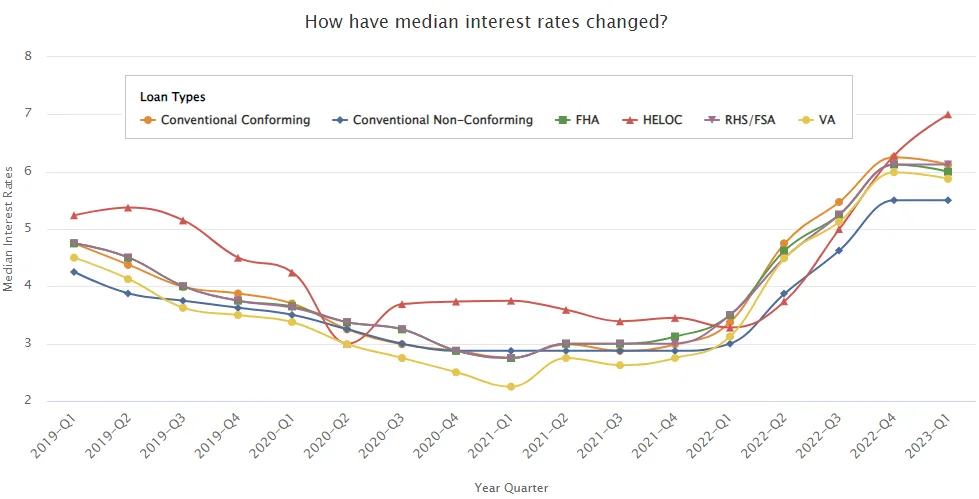

The interest rate environment fluctuates based on economic conditions and market trends. Staying informed about current trends can empower you to lock in a favorable rate at the right time.

Where to Find Information:

- Financial news websites Mortgage lender newsletters Economic reports from institutions like Freddie Mac or Fannie Mae

Leverage Down Payment Assistance Programs

Many local programs offer assistance that could lessen the burden of upfront costs associated with buying a home.

Popular Programs Available in Ann Arbor:

Michigan Down Payment Assistance Program City-specific grants or assistance programs Nonprofit organizations providing funding or resourcesEvaluate Different Loan Types

While most people think of standard fixed-rate mortgages when considering FHA loans, there are other options worth exploring including:

- Adjustable-rate mortgages (ARMs) The FHA 203(k) Rehab Loan (ideal for fixer-upper homes)

Seek Out Experienced Professionals

When dealing with complex financial decisions such as choosing an FHA mortgage lender in Ann Arbor or obtaining an fha refinance ann arbor option, consider working with professionals who specialize in this area.

How to Apply for an FHA Loan?

Applying for an fha mortgage loan ann arbor mi entails several steps:

Gather Required Documentation:- Proof of income (W2s and pay stubs) Bank statements Credit report authorization

- Fill out applications from various lenders. Provide documentation promptly.

- The lender will evaluate risk factors based on submitted data. Be prepared to answer additional questions if needed.

Common Misconceptions About FHA Loans

Despite their advantages, there are several myths surrounding fha loans michigan that could deter potential buyers from taking advantage of them:

Myth #1: You Need Perfect Credit

While better credit often yields better rates, there is no strict requirement that mandates perfect scores for approval.

Myth #2: Only First-Time Buyers Can Use Them

This isn’t true; even repeat buyers can benefit from fha loans ann arbor mi!

FAQs About Finding Rates on FHA Loans

FAQ 1: How do I find the best fha loan rates?

To find the best fha loan rates ann arbor mi offers:

- Shop around among multiple lenders Monitor market trends Improve your credit score where possible

FAQ 2: Can I refinance my existing fha mortgage?

Yes! An fha streamline refinance ann arbor option exists specifically designed to simplify refinancing without extensive paperwork or appraisal requirements.

FAQ 3: Are there specific lenders known as fha approved lenders ann arbor?

Yes! There are many recognized fha approved lender ann arbor options available—research and read reviews before selecting one!

FAQ 4: Is there down payment assistance available?

Certainly! Programs exist specifically aimed at assisting first-time homebuyers or those qualifying based on income levels within Ann Arbor County.

FAQ 5: What are some common fees associated with fha loans?

Common fees include origination fees (typically around 1% of loan amount), closing costs (which range widely), and mortgage insurance premiums (MIP).

FAQ 6: What is an fha 203k rehab loan ann arbor?

An fha 203k rehab loan enables borrowers to purchase homes needing repairs while incorporating those costs into their primary financing solution!

Conclusion

Navigating through the complexities of finding suitable rates on FHA loans in Ann Arbor does not have to be daunting if approached strategically! By understanding what makes these loans appealing while leveraging expert advice coupled with diligent research—homeownership becomes achievable sooner rather than later! So gear up; dive into the world of finance armed with knowledge—the keys await just beyond those doors!

With all these tips at hand about finding the best rates on fha loans ann arbor mi has available—you'll be well-equipped as you embark upon this exciting journey towards owning your dream home!